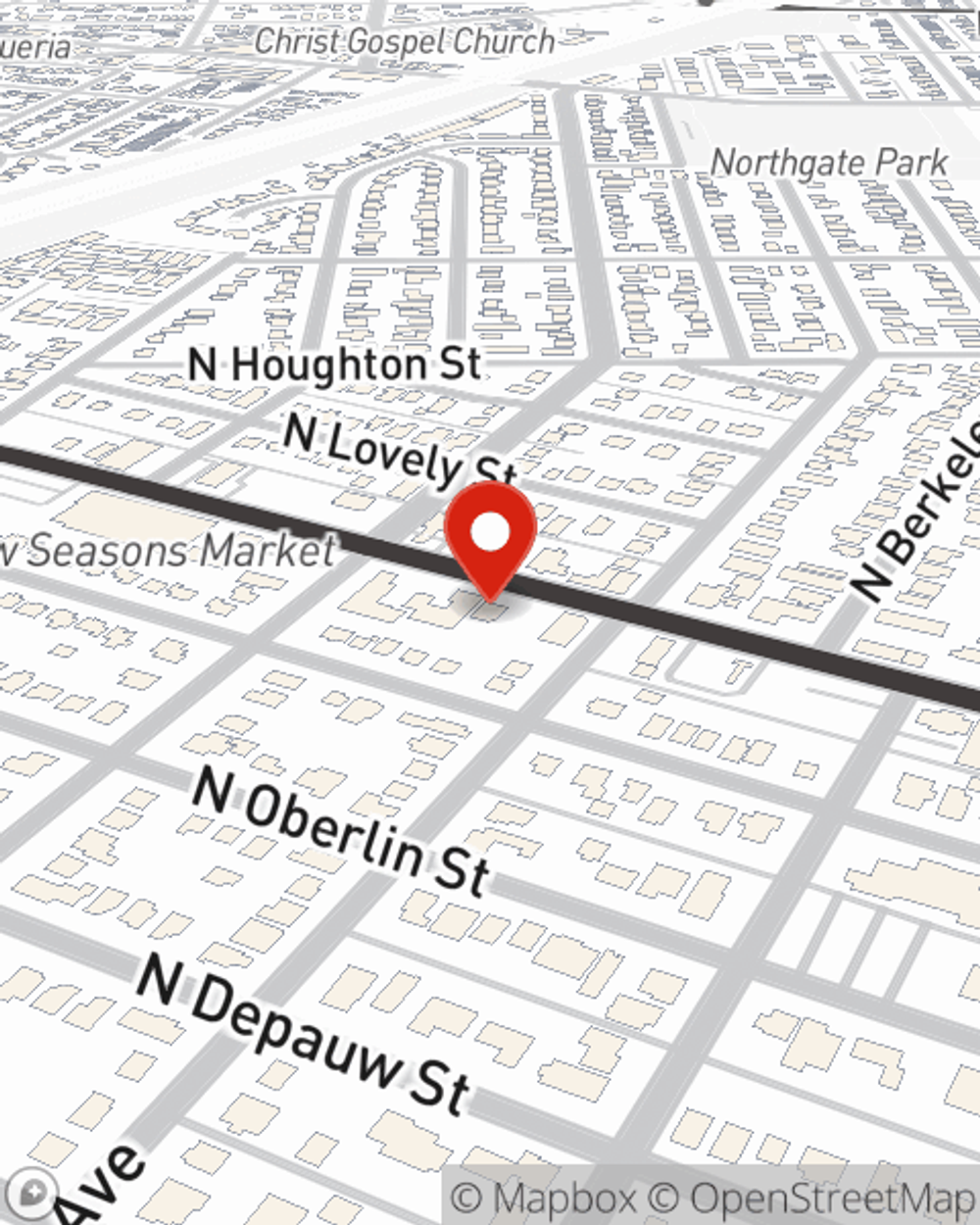

Renters Insurance in and around Portland

Looking for renters insurance in Portland?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your TV to your artwork. Not sure how much insurance you need? That's okay! Amber Scism is ready to help you identify coverage needs and help select the right policy today.

Looking for renters insurance in Portland?

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps safeguard your personal possessions in case of the unexpected.

More renters choose State Farm® for their renters insurance over any other insurer. Portland renters, are you ready to discover the benefits of a State Farm renters policy? Call or email State Farm Agent Amber Scism today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Amber at (503) 206-5850 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Amber Scism

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.